daily offer you can go for the day Purchase 3ETH and get 5ETH And so many of them You can chat with the online assist for full information on that. so many offers going on..

Cryptocurrencies

Cryptocurrency

This is the most popular type of digital asset in the market today. There are many cryptocurrencies in the market, the most popular being Bitcoin, Ethereum, Tether, Dogecoin, and Binance Coin.

Cryptocurrencies leverage the cryptographic foundation of a blockchain to store value, provide a means of exchange, and function as a unit of account. Cryptos are often referred to as digital money and can be bought, sold, and swapped on exchanges.

Managing your investments in uncertain times

We’re here to help you save for the future, through good markets and bad. Get our expert view on investing, staying the course, inflation and more.

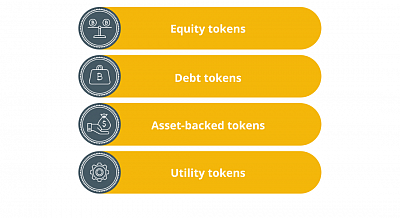

Security tokens

Security Tokens

Security tokens are digital assets that represent transferred ownership rights or asset value like real estate, vehicles, or corporate stock to a blockchain token. Depending on the scale of the physical asset, a security token can represent the whole or a fraction of the asset.

Real-World Asset Tokens

As the name implies, these types of digital assets are used to represent tangible real-world assets. Real-world asset tokens take on the value of the tangible asset by acting as a digital record of ownership. Because of this, they are often referred to as the digital shadow of a tangible real-world asset.

LOAN

A personal loan is a fixed amount of money you can borrow from a lender, with a specific length of time to repay it agreed at the start. An interest rate is also agreed on the loan, which affects how much you will pay back in total and your monthly repayments. These repayments may be spread over a number of years, depending on the size of the loan and your personal circumstances. You can usually borrow up to £25,000 with a personal loan, while higher amounts need to be secured against a house or other valuable asset.

Debt consolidation - Personal loans can be useful for managing your finances if you already have several monthly repayments for credit cards, overdrafts, store credit or other debts. A debt consolidation loan combines these debts into one monthly repayment, making it easier to manage.

Home, holiday, or car - A personal loan, also known as an unsecured loan, can be used for a variety of large purchases or costs. You might be looking at a family holiday, or you need a newer, more reliable car, or your house could do with a new kitchen or bathroom, a new sofa, or even vital repairs. A personal loan can be used for any of these up to a value of £25,000. Anything that costs more than this would need a secured loan.

With one quick and easy application, let Asda help search for the best loan rate to suit you

We've taken the work out of finding and applying for a personal loan. We work with a trusted panel of lenders to offer you great loan rates for your circumstances. If you're worried about being accepted for a loan, the soft search technology used means your credit score won't be affected when we check your eligibility. It's easy to apply, and you'll get an initial decision from lenders in minutes, so you don't have to put your plans on hold.

With so many options out there for personal loans, it can be tricky to know if you're making the right choice. At Asda Money we make it simple by only offering unsecured personal loans, so you don't have to be a homeowner to apply. This also means they can be used for all sorts of things, from debt consolidation to travel costs, home improvements, or a new car.

If you are thinking of consolidating existing borrowing you should be aware that you may be extending the terms of the debt and increasing the total amount

Solutions for you

*One

You can hold investments in different currencies with us. You can invest in any of our 11 currencies, hold cash and assets in multiple currencies, switch currency online, change the base currency of the platform at any time. Perfect for the internationally mobile investor.

*Two

You can hold a wide range of investments on our platform. Our open architecture platform allows investors to hold, funds, tradeable assets such as equities and ETFs and structured notes. You can hold everything in one place, which means it’s easy to get a bird’s eye view of your wealth.

*Three

Your investments and monies are safeguarded by us in line with best global practice and the stringent rules and guidelines of the Isle of Man Financial Services Authority.

*four

We are financially strong. We are part of IFGL which manages assets of over $11.5 billion for more than 80,000 customers around the world.

*Five

Our charges are transparent and extremely competitive. Our online technology increases efficiency and lowers the cost of managing a portfolio.

Contact us....

Learn more about us....